The Weekend Read from the Trading Desk: How upstreaming First Gen’s proceeds to First Philippine Holdings could stabilize ABS‑CBN—and safeguard the conglomerate’s access to bank capital.

The moment that changed the calculus

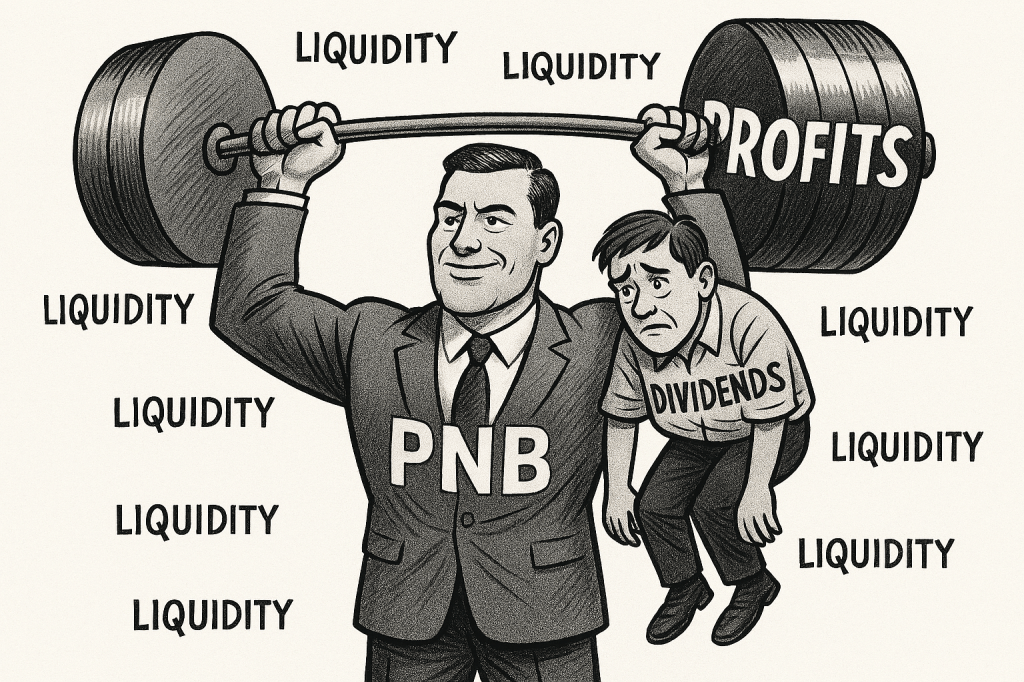

When Prime Infrastructure Capital, Inc. reached financial close on November 17–18, 2025, for its ₱50‑billion purchase of a 60% stake in First Gen Corporation’s (FGEN) Batangas gas platform—spanning the Santa Rita, San Lorenzo, San Gabriel, Avion plants and the offshore LNG terminal—the news cycle framed it as an energy transition milestone. But the deal also cracked open a once‑in‑a‑decade capital window for the Lopez Group: with liquidity crystallized at FGEN, the conglomerate can channel cash upstream to First Philippine Holdings (FPH) and redeploy it where reputational risk is highest—ABS‑CBN.

Prime Infra’s majority control across the mid‑stream and downstream gas value chain complements its upstream Malampaya operations, while FGEN retains 40% and a strategic voice—ensuring continuity and synergies even as capital is released. For Lopez watchers, the takeaway is simple: a ₱50‑billion windfall now sits where intercorporate cash movements are feasible and fast.

Why the windfall matters beyond energy

FPH directly and indirectly owns ~67.84% of FGEN’s common stock, giving it clear governance over dividend policy. That ownership is documented in PSE corporate filings and corroborated by independent market data services. In other words, FPH is positioned to receive any special cash dividends that FGEN’s board might declare in the wake of the Prime Infra transaction.

Critically, intercorporate dividends from a domestic corporation to another domestic corporation are tax‑exempt under Philippine law; such dividends are excluded from the recipient’s taxable income. This means FGEN → FPH cash upstreaming can occur with minimal leakage—a powerful lever when capital needs to move quickly within a group to neutralize risk elsewhere.

The crisis in the media arm—now a group‑wide concern

ABS‑CBN’s financial condition remains strained five years after the franchise loss. Public disclosures and Q3 2025 updates indicate ongoing losses and—more worryingly—technical default dynamics: loan covenant breaches and reclassification of interest‑bearing loans as current, which signal heightened acceleration risk. Even as content partnerships and digital pivots slowly rebuild revenue, liquidity remains tight.

Under the Financial Rehabilitation and Insolvency Act (FRIA), insolvency is assessed via cash‑flow (inability to pay debts as they fall due) and balance‑sheet (liabilities exceeding assets) tests. ABS‑CBN is not balance‑sheet insolvent today, but the cash‑flow risk is elevated because a technical default can quickly morph into payment default if lenders accelerate. That is the trigger point boards are paid to anticipate—and defuse.

The imperative: protect bankability across the Lopez constellation

Why move now? Because bank lenders assess conglomerates holistically. A distressed flagship can contaminate credit perceptions for siblings; in practice, ABS‑CBN’s covenant issues may constrain Lopez units’ access to new loans or favorable terms, no matter how robust their standalone metrics. For a group whose growth engine relies on long‑tenor project finance in power, real estate, and infrastructure, this is existential. The Prime Infra–FGEN deal gives Lopez the means to restore confidence quickly by stabilizing ABS‑CBN and thereby protecting the group’s credit story.

In capital markets, optics matter as much as numbers: a clean resolution of ABS‑CBN’s near‑term maturities and covenants reassures banks and rating committees that the group can manage cross‑portfolio risk. That reassurance is exactly what the windfall is designed to buy.

How the money moves: fast, tax‑efficient upstreaming

Mechanically, the simplest route is for FGEN to declare a special cash dividend, which FPH receives tax‑exempt as a domestic intercorporate dividend. FPH can then deploy proceeds into ABS‑CBN through equity infusion, secured shareholder loans, or escrowed cure funds structured to address current debt and lender waivers. The tax rules are clear, and the corporate records confirm FPH’s control of FGEN—a high‑certainty path with minimal friction.

Alternative capital return mechanisms—such as share buybacks or capital reductions—exist, but dividends are faster and cleaner for a time‑critical stabilization. The key is calibrating size: ₱12–₱15 billion can cure covenants, reclassify loans to noncurrent, and restore working capital; ₱20–₱24 billion provides a full reset, retiring near‑term debt and funding a 12‑month runway for operational turnaround.

The rescue blueprint in three moves

Move 1: Cure acceleration risk.

FPH funds an escrow to prepay or secure waivers on ABS‑CBN’s current loans, taking the oxygen away from technical default. This resets the maturity wall, buys time, and signals lender discipline at the corporate center.

Move 2: Rebuild working capital.

An equity injection restores the current ratio >1.0 and provides operating liquidity, crucial while monetization from content/IP and digital distribution scales. Stabilization capital is a bridge, not a destination.

Move 3: Consolidate governance—cash acquisition or share swap.

FPH can buy Lopez, Inc.’s 55.82% block of ABS‑CBN (documented in PSE Top‑100 stockholders lists and media ownership monitors), triggering a mandatory tender offer to minorities at the same price; or execute a share‑for‑share exchange that may qualify as a tax‑free reorganization under Section 40(C)(2). Both routes put ABS‑CBN inside FPH—simplifying accountability and capital discipline.

The rules of engagement: tender offers and antitrust

In the Philippines, the Securities Regulation Code (SRC) Rule 19 requires a mandatory tender offer when a person or group crosses control thresholds (e.g., ≥35% or >50%), or builds ≥15% within a year with intent declared. Offers can be cash or shares; fairness opinions are standard to protect minority holders. Proper sequencing and disclosures keep the process compliant and clean.

On antitrust, the Philippine Competition Commission (PCC) increased notification thresholds effective March 1, 2025, to ₱8.5 billion (Size of Party) and ₱3.5 billion (Size of Transaction). A FPH–ABS‑CBN control deal would likely surpass both, requiring compulsory notification and a formal review. PCC practice is established; early pre‑consultations can streamline timelines.

Share‑for‑share swaps: attractive—but mind the dilution

A share‑for‑share exchange offers an elegant, potentially tax‑deferred path under Section 40(C)(2) (CREATE), provided consideration is solely voting stock and the acquirer gains control. However, swaps issue new FPH shares, risking dilution of Lopez’s control at FPH if minorities receive paper. Boards must calibrate swap ratios to preserve governance while achieving consolidation.

The cash acquisition alternative addresses dilution outright. With liquidity from FGEN in hand, FPH can buy the controlling block and run the tender offer in cash—a faster, simpler route when the imperative is stability and bank optics.

FRIA as the backstop—why you don’t want to use it

While FRIA provides a court‑supervised path for rehabilitation with stay orders and receiver oversight, it is a backstop—not a strategy. Filing invites public scrutiny and can chill lenders across the group. The smarter move is pre‑emptive stabilization: cure covenants, remove acceleration threat, and avoid the optics of judicial intervention. Rescue capital is cheaper than the uncertainty of FRIA.

In short, FRIA is your Plan Z. If FGEN’s windfall exists precisely to avoid cross‑portfolio contagion, using FRIA would contradict the whole purpose of upstreaming liquidity.

Banking relationships: the real prize

For a conglomerate like Lopez, bankability underpins everything—from geothermal expansions to industrial parks and high‑rise communities. The Prime Infra–FGEN deal strengthens the energy narrative, but ABS‑CBN’s unresolved maturities can still cast a shadow. Stabilization is therefore not merely a media rescue; it is a capital markets strategy to protect borrowing capacity at scale.

Bank credit committees do not compartmentalize risk as neatly as organograms do. Demonstrating swift, disciplined resolution at ABS‑CBN sends a signal that group governance is active and integrated—a signal banks reward with pricing and availability.

Governance and optics: doing right by minorities

If FPH acquires ABS‑CBN control, minority shareholders must be offered the same price via the tender offer. Independent fairness opinions and transparent valuation disclosures mitigate controversy and preserve trust. In prior public M&A, these mechanics have helped align stakeholder expectations and reduce litigation risk. The playbook is established; the onus is on execution quality.

For antitrust, scheduling and completeness matter. PCC has clear thresholds and review processes; a disciplined filing is table stakes. Early engagement often trims the calendar and clarifies scope, limiting uncertainty for lenders and markets.

A realistic timeline

Weeks 0–8: FGEN Board approves special dividend; FPH receives cash tax‑exempt and announces allocation priorities.

Weeks 4–16: FPH funds loan cure/waivers and injects working capital into ABS‑CBN; public updates reinforce lender confidence.

Weeks 8–26: Execute cash acquisition of controlling block and launch tender offer; notify PCC; close and integrate governance.

What success looks like in 12–18 months

- ABS‑CBN: No technical default; current ratio >1.0; maturities normalized; EBITDA trending positive on content/IP monetization and disciplined costs.

- FPH: Governance simplified (FPH → ABS‑CBN), capital discipline visible, and borrowing capacity intact for renewables and real estate.

- FGEN: Balanced energy portfolio post‑transaction, with renewables expansion funded and gas partnership synergy intact.

The cost of inaction

Conglomerates are judged by how they manage the weakest link. If ABS‑CBN’s debt profile remains unresolved, lenders will price risk across the group, blurring distinctions between strong and weak units. With ₱50 billion already realized at FGEN, failing to upstream and act would be a strategy error—one that risks higher funding costs and constrained growth at precisely the wrong moment for the Philippines’ clean‑energy and infrastructure agenda.

The Lopez Group has the tools, the capital, and—thanks to Prime Infra—the timing. This isn’t just about saving a media icon; it’s about protecting bankability and future‑proofing a storied conglomerate. Rescue capital today is the price of strategic freedom tomorrow.

Sidebar: Who owns what—and why it helps

Public data shows Lopez, Inc. as ABS‑CBN’s controlling shareholder (about 55.82% of common shares), with FPH controlling FGEN and thereby the dividend spigot. Consolidation of ABS‑CBN into FPH—whether by cash acquisition or share swap—aligns incentives and simplifies lender narratives. Ownership clarity and capital discipline are precisely what credit committees want to see when risk needs to be re‑rated.

The closing argument

A ₱50‑billion energy transaction has created a once‑in‑a‑generation opportunity to stabilize ABS‑CBN and protect the Lopez Group’s access to bank capital. The mechanics are straightforward, the tax path is efficient, and the regulatory routes are well‑trodden. In corporate strategy, timing is everything. The Lopez Group’s moment is now.

Subscribe to Support Free & Independent Research