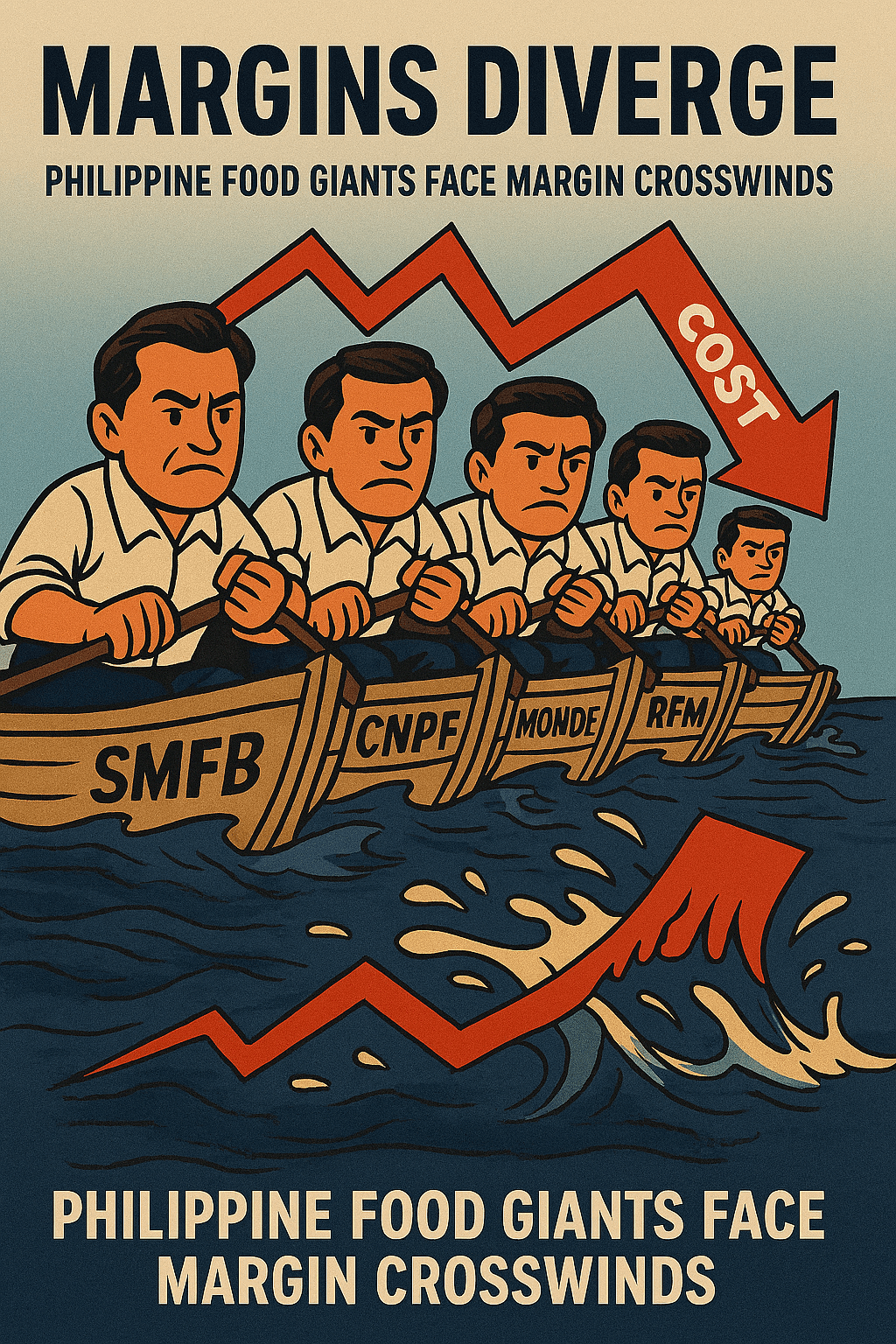

SMFB widens profitability; CNPF and MONDE see compression; URC nudged lower; RFM holds firm despite cash flow squeeze

The Philippines’ leading packaged food and beverage players posted mixed margin outcomes in their nine‑month 2025 results, highlighting how input-cost volatility, pricing discipline, and working‑capital choices are reshaping profitability across the sector. Sales growth was broadly positive, but margin trajectories diverged: San Miguel Food and Beverage (SMFB) expanded margins; Century Pacific Food (CNPF) and Monde Nissin (MONDE) saw compression; Universal Robina Corp. (URC) edged lower; and RFM Corp. preserved healthy margins while absorbing a hit to operating cash flows.

Sales: Mid‑single to high‑single digit growth, with branded segments leading

SMFB’s consolidated revenues rose 4% to ₱302.9 billion on resilient demand and brand execution across food, beer, and spirits—food up 7%, spirits up 7%, beer steady—supporting scale benefits into the third quarter. Management underscored supply chain productivity and capacity expansion as margin enablers alongside revenue momentum.

URC delivered ~5% top‑line growth (TTM revenue ₱166.1 billion), propelled by snacks and ready‑to‑drink beverages domestically and stronger performance from Munchy’s in Malaysia and Indonesia. However, elevated coffee input costs—still roughly twice 2023 levels—tempered EBIT expansion, setting the stage for margin pressure despite volume gains.

CNPF’s sales grew 8% to ₱61.8 billion, with the branded portfolio up 12% and OEM exports recovering after a soft first half. Management flagged “all‑weather” staples demand, easing inflation (notably rice), and brand investments as the primary growth drivers into Q3, where quarterly revenue accelerated 15% year‑on‑year.

Monde Nissin posted 3.5% growth to ₱63.3 billion, anchored by APAC Branded Food & Beverage (BFB) up 4.4% year‑to‑date, while meat alternatives contracted 3.9% on a constant‑currency basis. The company cited biscuits and “others” categories as domestic volume pillars and guided to sequential BFB margin improvement heading into 4Q25–2Q26.

RFM recorded 1.8% sales growth to ₱15.23 billion, indicative of flat-to-steady demand in pasta, milk, flour, buns, and ice cream JV products. Despite modest revenue growth, management reiterated its confidence in a stronger fourth quarter driven by category momentum and historical seasonality.

Margins: SMFB expands; CNPF and MONDE compress; URC softens; RFM resilient

SMFB: Group profitability improved, with EBITDA up 13% to ₱58.4 billion and overall margins widening to 19%. Margin gains were attributed to cost and operational efficiencies across divisions, most notably in food and spirits, with disciplined pricing underpinning resilience against weather‑related disruptions.

URC: Gross margin around 26.1% on a trailing basis, below FY2024’s ~27.0% and the company’s five‑year average (~27.7%), reflecting persistent coffee cost inflation and normalization across commodities. Management acknowledged EBIT pressure in the Philippines, partially offset by overseas scale and cost programs, implying modest margin decline versus last year despite top‑line strength.

CNPF: Gross margin compressed by 110 bps to 25.5% year‑to‑date, driven by normalizing input costs after a period of favorable commodity tailwinds. Notably, operating expenses fell 90 bps as a share of sales, cushioning the margin squeeze and allowing net income to grow 10% to ₱5.8 billion.

Monde Nissin: Consolidated gross margin declined 160 bps to 33.3% for nine months, with edible oil inflation weighing on APAC BFB even as sequential margin recovery emerged on pricing actions and reformulation. Meat alternatives posted gross margin improvement and EBITDA positivity, but the segment’s revenue contraction offset group‑level gains, resulting in overall margin decline year‑to‑date.

RFM: Margins remained strong despite flat sales—EBITDA of ₱830 million, implying an EBITDA margin of ~15.2%—as lower selling and marketing expenses and lean G&A lifted operating margin to ~11.2%. While the company did not report year‑on‑year basis‑point changes, commentary and segment detail point to a stable-to‑improving margin mix led by consumer products.

Operating Cash Flow: Strength for MONDE and URC; strain at RFM; SMFB and CNPF steady

Monde Nissin reported ₱8.7 billion operating cash flow in the period, supported by lower operating costs in meat alternatives, foreign‑exchange tailwinds, and targeted pricing in APAC BFB, even as edible oils remained a drag on gross margins. URC likewise showed solid cash generation (TTM operating cash flow ₱12.86 billion), underpinned by working‑capital normalization across branded and commodities businesses.

RFM’s operating cash flow fell sharply to ₱141 million from ₱1.3 billion a year ago, largely due to inventory buildup (over ₱1 billion) and reduced payables, which tightened liquidity despite sound income statement margins. Management emphasized inventory normalization and cash discipline as fourth‑quarter priorities.

SMFB highlighted a solid financial position—with sustained earnings power and prudent capital management—but did not disclose detailed nine‑month OCF figures. CNPF continued to invest in strategic growth (plant‑based and coconut operations) while maintaining low leverage and healthy liquidity metrics, reinforcing cash resilience despite gross margin compression.

Balance Sheets: Liquidity cushions intact; leverage disciplined

SMFB’s disclosures show total consolidated debt of ₱ 187.2 billion as of September 30, 2025, balanced by robust earnings and margin expansion across key segments, providing flexibility for capacity investments and brand support.

URC’s financials reflect a strong asset base and conservative leverage, with ongoing margin headwinds from coffee mitigated by international scale and cost controls; CNPF maintains a current ratio of ~2.0 and a debt‑to‑equity ratio of ~0.24, indicating prudent gearing.

Monde Nissin maintains a net cash position (₱11.2 billion), a current ratio of 2.34, and minimal debt, reinforcing flexibility to sustain dividend payouts and fund margin‑restoration initiatives in APAC BFB. RFM also sits on net cash with current ratio ~1.36, though the nine‑month working‑capital swing is a near‑term watch‑item.

Bottom Line: Five companies, five margin paths

- SMFB stands out for margin expansion via cost discipline and pricing, despite weather and input‑cost noise.

- URC delivers volume‑led growth but faces slightly lower gross margin amid elevated coffee costs.

- CNPF sustains double‑digit profit growth even as gross margin compresses on commodity normalization.

- Monde Nissin shows sequential margin recovery but a year‑to‑date decline, with edible oils the main headwind and meat alternatives improving.

- RFM maintains strong margins but must rebuild operating cash flow after a working‑capital drawdown.

Investor lens: Expect continued focus on pricing, mix, and cost programs to protect margins, with working‑capital discipline (especially inventories and payables) a differentiator into year‑end. Companies with net cash and low leverage (Monde, RFM, CNPF) retain optionality for dividends and capex, while scale players (SMFB, URC) leverage brand strength to buffer input volatility.

SUBSCRIBE TO SUPPORT FREE & INDEPENDENT RESEARCH