We’ve been blogging for free. If you enjoy our content, consider supporting us!

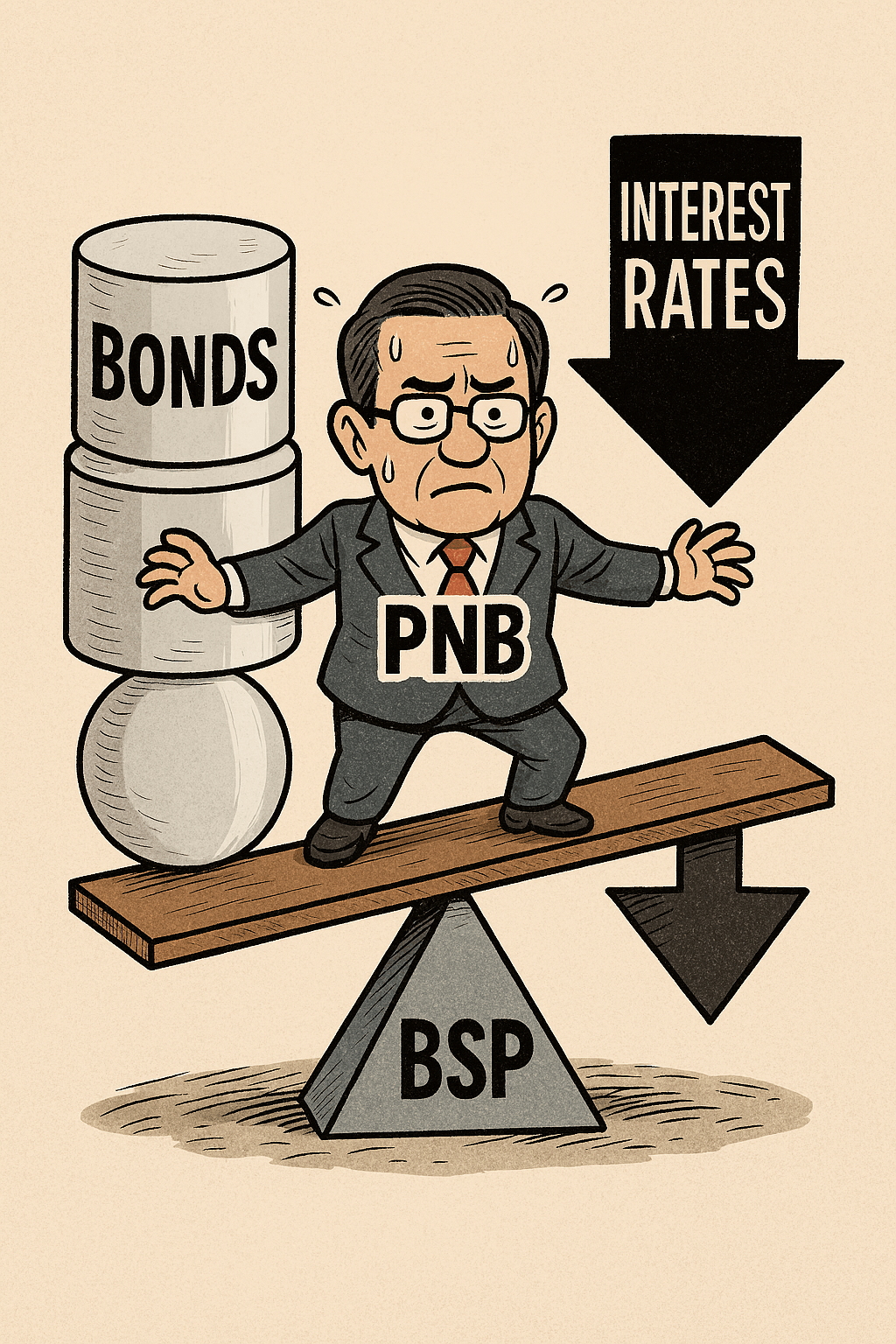

Philippine National Bank’s return to the peso bond market would normally be filed under “good news”: strong demand, a sizeable PHP 15.7 billion raise, and a clear promise to funnel proceeds into eligible projects under its Sustainable Financing Framework. But markets don’t grade banks on deal headlines—they grade them on spread, the narrow space between what a bank earns on assets and what it pays for money. And that spread is now facing a two-sided pincer: a fresh BSP rate cut that can pull loan yields down, and new fixed-rate bond funding that doesn’t reprice lower.

A bond deal priced for yesterday’s rate environment

PNB’s issuance came in two tranches: Series A (3-year) at 5.4877% and Series B (5-year) at 5.7764%, for a combined PHP 15.7 billion. Those are clean, tradable coupons investors like because they are predictable. For the bank, however, predictability cuts both ways: these rates are locked in, creating a relatively firm “floor” for a portion of PNB’s funding costs over the next three to five years.

That matters because PNB’s earnings machine is still overwhelmingly powered by net interest income. In its latest quarterly filing covering the period ended September 30, 2025, PNB reported net interest income of PHP 39.3 billion and a net interest margin (NIM) of 4.7% for the first nine months of the year. When a bank introduces more wholesale, fixed-rate funding into the mix, it increases the chance that overall funding costs drift upward—unless the proceeds are deployed into assets that earn meaningfully more than that fixed coupon.

Then came the BSP’s easing move—lower policy rates, lower pricing gravity

On December 11, 2025, the Bangko Sentral ng Pilipinas cut the target reverse repurchase (RRP) rate by 25 bps to 4.50%, citing benign inflation and weaker growth, while signaling the easing cycle may be nearing its end. A policy rate cut is not just a macro headline; it’s a pricing signal that seeps into the banking system. Over time, it can soften interest rates across the curve—deposit pricing, wholesale funding benchmarks, and critically, loan pricing.

And that’s where the profitability tension sharpens. In easing cycles, banks often hope for a benign sequence: funding costs fall faster than asset yields, supporting NIM. But when a bank adds fresh fixed-rate bond funding, it risks changing that sequence. Bond coupons don’t follow the BSP downward. Meanwhile, loan yields—especially for new production or repriced credits—can trend lower as the overall cost of money declines and competition intensifies.

The core risk: loan yields may fall, but bond funding stays expensive

Here is the cleanest way to see the risk: the BSP’s rate cut pulls down the “gravity” of borrowing costs. When benchmark rates move lower, banks typically face pressure to reprice or originate loans at lower rates—particularly in competitive segments and for high-quality borrowers. That means asset yields can fall over time.

But PNB’s new bond funding is priced in the mid‑5% range and is fixed. If loan yields soften due to easing—while bond coupons remain unchanged—then the spread between what PNB earns and what it pays can narrow. That is textbook margin compression: assets reprice down, liabilities don’t fully follow, and NIM drifts lower even when volumes are growing.

The risk is not theoretical. PNB’s 17‑Q already shows how meaningful interest expense is to the model: for the first nine months of 2025, total interest expense was PHP 13.07 billion, including PHP 630.3 million for “bonds payable.” Add more bond funding and—unless deployment is swift and high-yielding—interest expense becomes stickier at precisely the moment the BSP is trying to make money cheaper.

Why the first few quarters after issuance matter most

A second layer of risk is timing. Bond proceeds arrive quickly; loan deployment—especially into projects that meet sustainability criteria—can take longer. PNB itself states the net proceeds will be used to finance or refinance eligible projects under its framework. If deployment lags, banks often park funds temporarily in liquid assets. In a falling-rate environment, those liquid assets may earn less, while bond coupons keep running—turning the early months into a “negative carry” window that can pull on NIM.

This is why investors shouldn’t judge the bond deal by oversubscription alone. The real scoreboard is whether the bank can keep its margin stable while adding fixed-rate funding. PNB’s reported 4.7% NIM provides a useful baseline heading into the post-issuance period.

The counterpoint: rate cuts can boost loan demand—volume can cushion the squeeze

To be fair, BSP easing can also be helpful for banks. Lower policy rates are designed to support activity; they can lift credit demand, encourage refinancing, and reduce debt service burdens. If loan volumes accelerate enough, banks can sometimes offset thinner spreads with higher earning-asset balances. PNB’s own 17‑Q shows that loans and receivables rose 6.5% versus year-end 2024, indicating momentum in asset growth even before the December cut.

But volume is not a free pass. When rates fall, banks must avoid the temptation to buy growth at the expense of pricing discipline—especially if they are carrying fixed-rate liabilities that won’t reprice lower. If PNB uses the bond proceeds to fund assets that are either low-yielding or aggressively priced, the “growth story” can still translate into weaker NIM.

What to watch: three tells that reveal whether NIM holds or slips

Because the bond was listed on December 11, 2025, the post-issuance effect will show up more clearly in subsequent periods rather than the September 30, 2025 filing. When PNB reports new numbers, three items will tell the story quickly:

- Loan yield trend — do new bookings and repricings show softening rates consistent with BSP easing?

- Funding cost mix — does the new bond carry make interest expense less responsive to falling rates?

- NIM direction vs 4.7% baseline — does it hold, or does the combination of lower loan yields and fixed bond coupons compress the spread?

Bottom line

PNB’s bond issuance strengthens funding diversification and signals confidence, but the macro backdrop has shifted: the BSP has lowered the policy rate to 4.50%, reinforcing a downtrend in borrowing costs that can pull loan yields lower. With PNB’s new bond financing locked at 5.49%–5.78%, a portion of the bank’s funding costs becomes fixed and comparatively expensive just as the system is easing. If loan rates fall faster than the bank’s blended funding costs, the natural result is net interest margin compression—a risk that will only be confirmed (or disproved) in the coming quarters’ NIM and net interest income prints.

We’ve been blogging for free. If you enjoy our content, consider supporting us!

Leave a comment