From the Trading Desk.

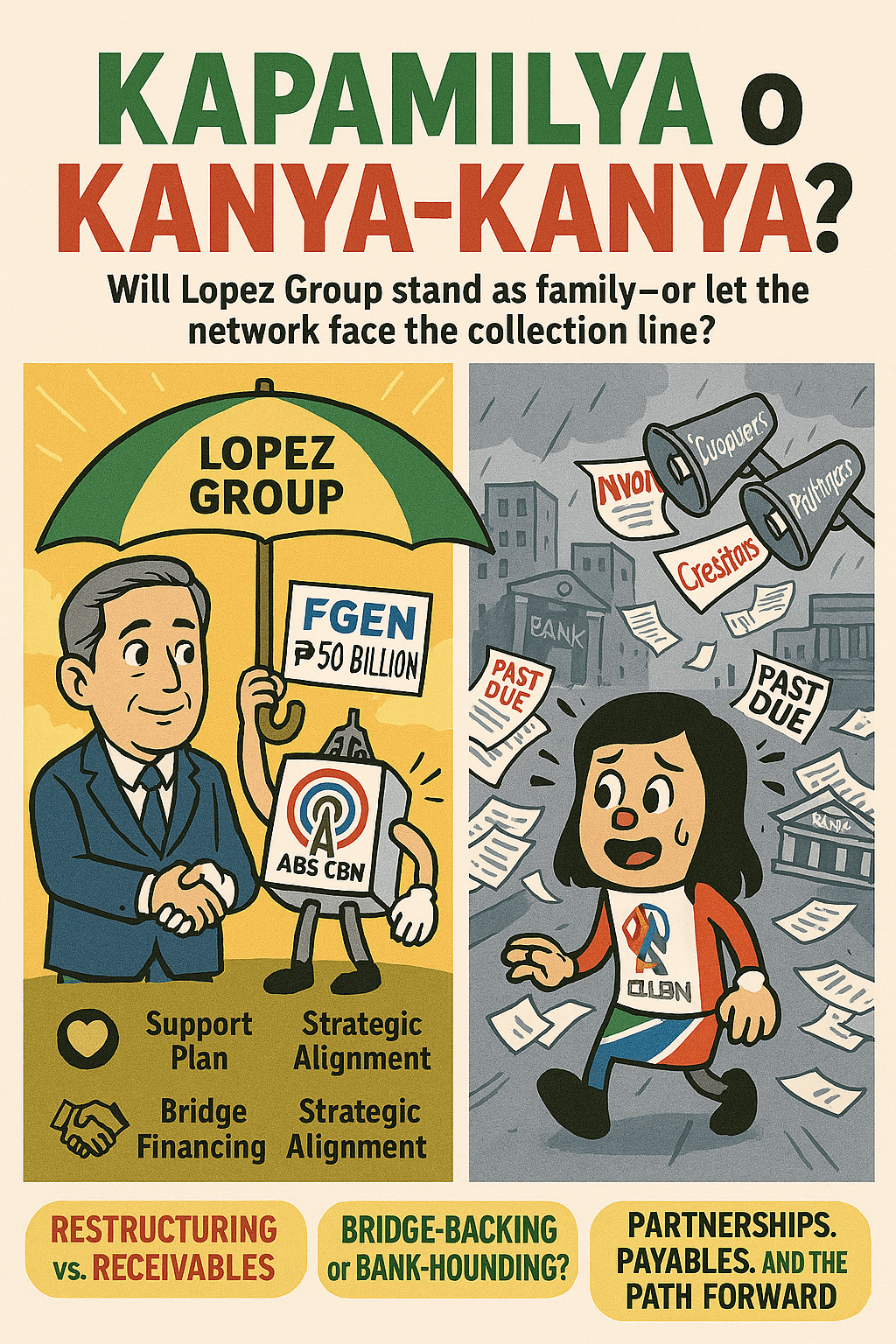

The Lopez Group faces a moment that calls for clear, steady action. TV5’s notice to end its content deal with ABS‑CBN—which ABS says it’s working to resolve—puts pressure on ABS’s cash flows and its relationships with partners. Letting that pressure linger risks bigger problems.

The most straightforward fix is to bring ABS under First Philippine Holdings (FPH) through a share swap—and then use First Gen (FGEN) cash to help ABS regain its footing. Here’s why this path makes sense, quickly and simply:

1) Put ABS under the strongest umbrella

Inside the Lopez Group, ABS sits under Lopez Holdings, while FPH is the parent for major businesses like First Gen (power) and Rockwell Land (property). Moving ABS under FPH aligns responsibility and resources in one place and avoids messy intercompany band‑aids. It’s a clean, familiar step for listed companies in the Philippines.

2) Use the cash that already exists

In November 2025, First Gen closed a ₱50 billion deal with Prime Infrastructure, selling 60% of its Batangas gas plants and the LNG terminal while keeping 40% (Tokyo Gas holds 20% in the LNG hub). That transaction brought in real cash. A special dividend from FGEN to FPH immediately equips FPH with funds to settle partner obligations, stabilize operations, and give ABS breathing room after the share swap.

There’s a bonus: in the Philippines, cash dividends between local companies aren’t taxed at the recipient company, making FGEN → FPH a fast, efficient way to move support where it’s needed.

3) This doesn’t weaken Lopez control of FPH—if anything, it can increase it

Some might worry that issuing new FPH shares for a 100% ABS swap would dilute Lopez control. In practice, it won’t:

- Before the swap, Lopez Holdings (LPZ) owns about 55.6% of FPH (per FPH’s Public Ownership Report).

- After a full ABS‑for‑FPH share swap (priced on recent trading averages), LPZ’s stake in FPH would likely tick up—roughly into the low‑to‑mid 60% range—because LPZ would receive the new FPH shares issued as consideration. In other words: more FPH shares end up with Lopez Holdings, so control does not fall; it can rise. (This is based on recent market data for ABS and FPH and simple share‑count math; inputs such as ABS’s outstanding shares and recent prices come from PSE EDGE.)

And since FPH already has a healthy public float, that small increase in Lopez ownership does not threaten the exchange’s minimum public‑ownership rules.

4) Doing nothing costs more

Waiting invites headlines, frays trust with partners, and makes a later fix more expensive. A share swap + FGEN special dividend is decisive, transparent, and fast. It shows banks, advertisers, and viewers that ABS’s finances are under firm stewardship—with the scale and discipline of FPH behind it.

Bottom line:

The likely move is ABS under FPH via share swap, funded by an FGEN special dividend—and Lopez control of FPH won’t be diluted by doing this. It’s the simplest way to restore confidence and give ABS the time it needs to get fully back on its feet.

Because the FGEN cash is already real, many investors will naturally front‑run the possibility of a special dividend flowing to FPH—and, by extension, to all FGEN shareholders. In that sense, the market may treat FGEN like a buy‑for‑dividend‑optionality story right now, pending board moves. (Again, this is sentiment—not a recommendation.)

Leave a comment