Puregold Price Club, Inc. (PGOLD) has once again demonstrated its resilience in the Philippine retail landscape, posting a net income of ₱7.3 billion for the first nine months of 2025, up 5.6% year-on-year. Sales surged 10.6% to ₱168.1 billion, powered by aggressive store expansion and steady same-store sales growth. Yet behind the headline numbers, a closer look at the company’s latest SEC filing reveals operational pressure points that could shape its trajectory into 2026.

The Good News: Scale and Margins Hold

Puregold’s top line benefited from the full-year impact of 2024 openings and 174 new stores launched in 2025, including one S&R warehouse. Same-store sales growth was healthy: Puregold +4.8%, S&R +5.4%, signaling consumer stickiness despite inflationary headwinds.

Gross margin improved to 18.7% from 18.2%, thanks to supplier rebates and scale efficiencies. Operating income rose 8.2% to ₱11.3 billion, though operating margin slipped slightly to 6.7%. Net margin eased to 4.3%, reflecting higher financing costs and foreign exchange losses.

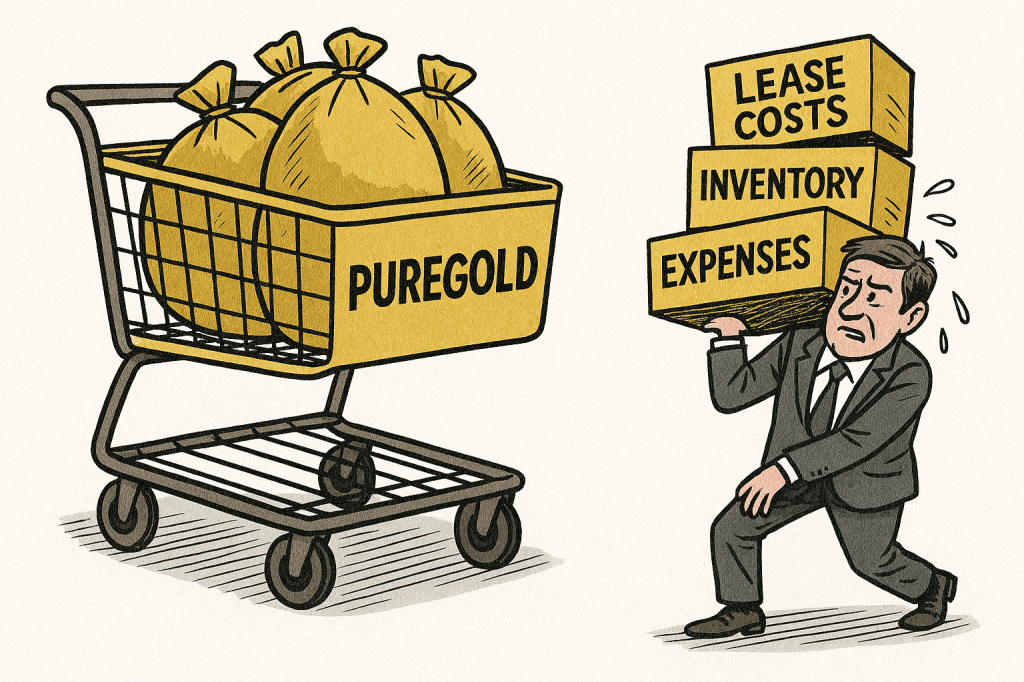

The Pressure Points

While management asserts “no known material uncertainties,” the numbers tell a nuanced story:

- Opex Surge: Operating expenses jumped 16.5%, outpacing sales growth. Expansion costs—manpower, utilities, depreciation—are biting into margins.

- Lease-Heavy Model: Lease liabilities ballooned to ₱49.7 billion, underscoring Puregold’s reliance on rented space. Gains from lease terminations hint at active pruning but also raise questions about site-selection discipline.

- S&R Basket Conundrum: Traffic soared 15.8%, yet average basket size fell 9%. More trips, smaller baskets—a trend that could pressure profitability if not reversed during the holiday peak.

- Working Capital Strain: Inventory climbed 16.1% to ₱34.2 billion, while cash dropped 28.7%. Liquidity remains strong (current ratio 3.22x), but cash conversion will be critical in Q4.

- Finance and FX Costs: Other charges rose 25%, driven by interest and a ₱288 million FX loss, partially offset by lease termination gains.

Governance and Related-Party Exposure

The report also flags significant related-party leases, totaling ₱5.7 billion. While common in Philippine retail, such arrangements warrant scrutiny for pricing fairness and renewal risk.

Investor Takeaways

Puregold’s fundamentals remain solid: strong brand equity, scale advantages, and liquidity buffers. But the cost discipline challenge is real. Expansion is a double-edged sword—fueling growth while amplifying execution risk. For investors, the Q4 holiday season will be the litmus test: can Puregold convert inventory into cash, normalize S&R baskets, and defend margins?

If it succeeds, PGOLD stays a defensive play in consumer staples. If not, 2026 could bring margin compression and a rethink of its lease-heavy growth model.

Bottom Line: Puregold is still a growth story—but one that demands sharper cost control and strategic agility. In retail, size matters, but efficiency matters more.

Leave a comment