Philippine National Bank (PNB) has delivered a headline that investors love: ₱18.5 billion in net income for the first nine months of 2025, up 22.9% year-on-year. Capital ratios remain fortress-like, with CET1 at 19.95% and CAR at 20.79%, well above regulatory floors. On the surface, this looks like a bank in peak health.

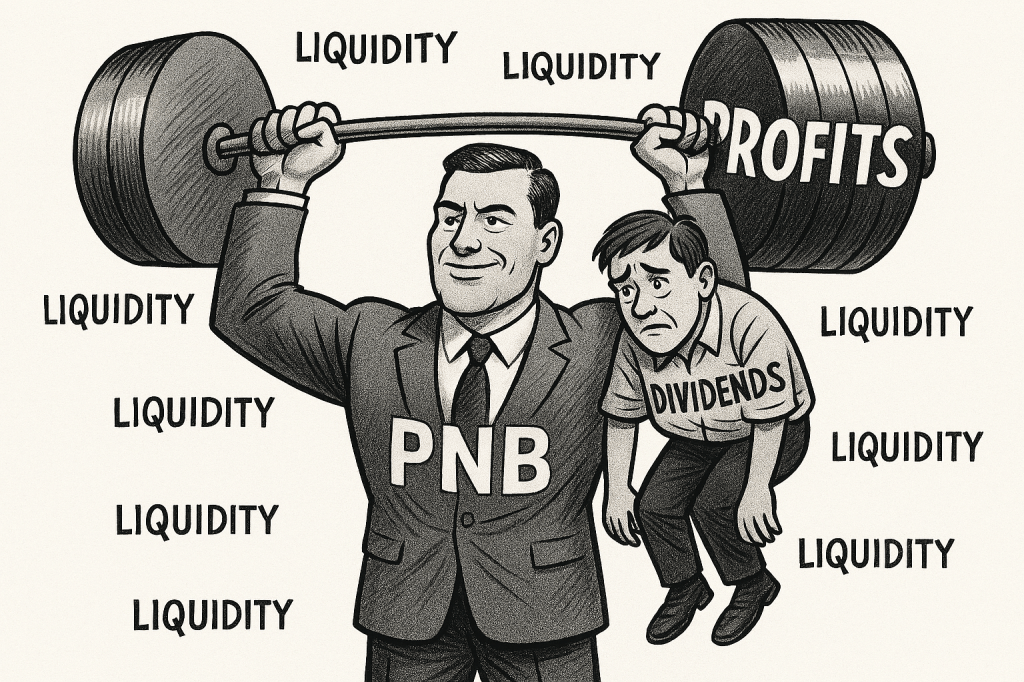

But beneath the glossy earnings lies a story of structural vulnerabilities—issues that could weigh on liquidity, credit resilience, and ultimately, shareholder returns.

Liquidity Compression: The Silent Stress

PNB’s liquid assets plunged 26% year-to-date, from ₱222.2 billion to ₱164.4 billion. Liquidity ratios deteriorated sharply: liquid assets-to-total assets fell to 19% from 29%, and liquid assets-to-liquid liabilities slid to 24.4%. Deposit liabilities contracted by ₱22.2 billion, with time deposits down 5.5%.

In a high-rate environment, shrinking liquidity buffers limit flexibility. Boards typically prioritize cash preservation over payouts when liquidity tightens—making aggressive dividend hikes unlikely.

Allowance Releases Inflate Earnings

Loan-loss provisions collapsed to ₱473 million from ₱3.7 billion a year ago, while charge-offs surged to ₱6.6 billion. Allowance for credit losses fell by ₱5.4 billion, reducing NPL coverage to 81.8% from 87.3%.

This accounting tailwind flatters profitability but is not sustainable. If macro conditions worsen, PNB may need to rebuild reserves—pressuring future earnings and payout ratios.

Earnings Quality Risks

PNB booked ₱1.9 billion in gains from asset sales, including foreclosed properties, which also grew by 8.2% to ₱17.3 billion. These gains are opportunistic, not structural. Heavy reliance on one-off disposals inflates ROE and masks underlying credit costs. If disposal markets soften, earnings volatility could spike.

Related-Party Concentration

Receivables from related parties total ₱50.8 billion, with another ₱44.9 billion in credit facilities and ₱45.3 billion in related deposits. Unquoted FVOCI equity includes a ₱25.5 billion stake in PNB Holdings, valued using NAV with a discount for lack of marketability.

High intra-group exposures raise governance and concentration risk. Any stress within the LT Group ecosystem could cascade into PNB’s balance sheet.

Why It Matters

Strong capital ratios are reassuring, but these weaknesses signal that headline profits may not fully translate into sustainable shareholder returns. Expect a conservative dividend stance and a valuation discount if liquidity and governance concerns persist.

For investors chasing yield, the message is clear: not all high profits guarantee high payouts—especially when risk metrics are flashing amber.

Leave a comment